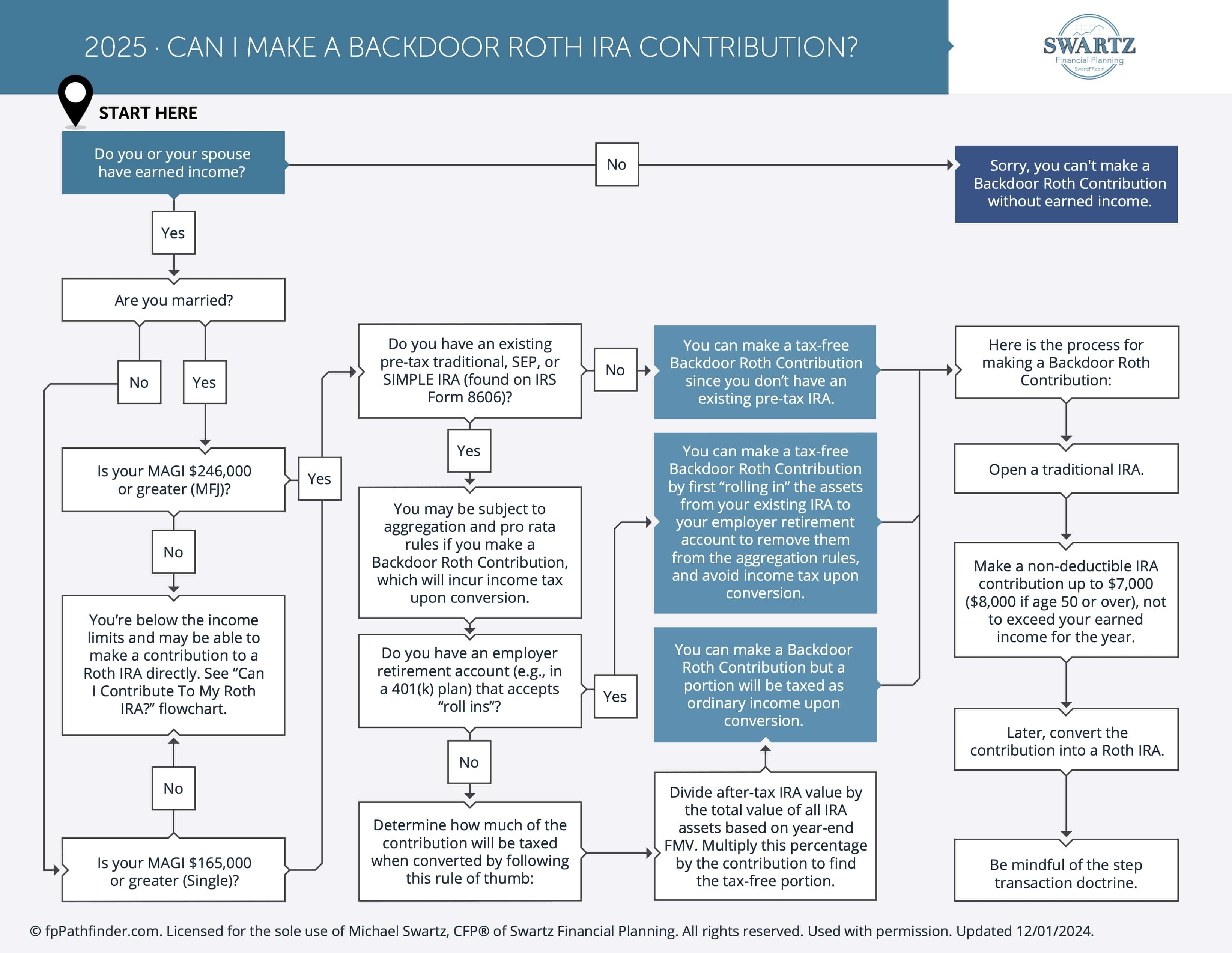

Can I Do A Backdoor Roth IRA Contribution?

Can I Do A Backdoor Roth IRA Contribution? This flowchart will guide you through the eligibility factors.

In the landscape of retirement planning, shrewd investors are perpetually in pursuit of strategies to optimize savings and tax efficiency. One such strategy that frequently grabs attention is the backdoor Roth IRA contribution. But what exactly does this entail, and who qualifies for it? In this article, we’ll delve into the intricacies of backdoor Roth IRA contributions. We will be shedding light on how they function, their beneficiaries, and the steps involved in executing this tactic.

A backdoor Roth IRA contribution is a method of indirectly funding a Roth IRA. This bypasses the income limitations that typically hinder high-earning individuals from making direct contributions. While income constraints exist for direct Roth IRA contributions, no such barriers exist for converting funds from a Traditional IRA to a Roth IRA. As a result, individuals with incomes exceeding the Roth IRA contribution thresholds can leverage the backdoor strategy. This will indirectly finance a Roth IRA.

Who Can Reap the Benefits of a Backdoor Roth IRA Contribution?

This strategy is particularly advantageous for individuals who:

- Exceed the Roth IRA contribution limits: As of 2024, those with modified adjusted gross incomes (MAGIs) surpassing $144,000 (for single filers) or $214,000 (for married couples filing jointly) cannot make direct contributions to a Roth IRA.

- Seek tax-free growth and withdrawals in retirement: Roth IRAs offer the potential for tax-free growth and withdrawals during retirement. This makes them appealing for long-term savings.

- Have funds available for conversion: To execute the strategy, individuals must have funds available in a Traditional IRA, either through contributions or rollovers from other retirement accounts.

How Does a Backdoor Roth IRA Contribution Operate?

The execution typically involves the following steps:

- Make a nondeductible contribution to a Traditional IRA: Individuals contribute after-tax funds to a Traditional IRA, irrespective of their income level or participation in an employer-sponsored retirement plan.

- Convert the Traditional IRA funds to a Roth IRA: Following the nondeductible contribution, individuals transfer the funds to a Roth IRA by converting them from the Traditional IRA. As the funds were previously taxed upon contribution to the Traditional IRA, the conversion generally incurs minimal to no additional tax liability.

Considerations

Before embarking on the strategy, individuals should weigh the following factors:

- Tax Implications: While the conversion itself may carry minimal tax consequences, individuals should remain cognizant of potential tax implications. Such as the pro-rata rule, which applies to conversions involving pre-tax and after-tax funds within Traditional IRAs.

- Long-Term Retirement Objectives: Assess whether a Roth IRA aligns with long-term retirement goals. Also if it aligns with financial aspirations, considering factors such as anticipated tax brackets during retirement and the desire for tax-free withdrawals.

- Professional Guidance: Given the intricacies of retirement planning and tax matters, seeking advice from a financial advisor or tax professional can offer valuable insights and direction when implementing the strategy.

Conclusion

Backdoor Roth IRA contributions present a valuable avenue for high-income earners. They can access the perks of a Roth IRA, including tax-free growth and withdrawals during retirement. By grasping the mechanics of this approach and reflecting on individual financial circumstances, investors can leverage the backdoor strategy to enhance their retirement savings and tax efficiency. Whether aiming to diversify retirement portfolios or maximize opportunities for tax-advantaged savings, exploring the potential benefits of this strategy could prove beneficial within the broader financial plan.

See more flowcharts here!

This article is educational only and is not intended to be investment, legal, or tax advice or recommendations, whether direct or incidental. Again, this is not investment advice. Consult your financial, tax, and legal professionals for specific advice related to your specific situation. Never take investment advice from someone who doesn’t know you and your specific situation. All opinions expressed in this article are those of the people expressing them. Any performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be directly invested in.