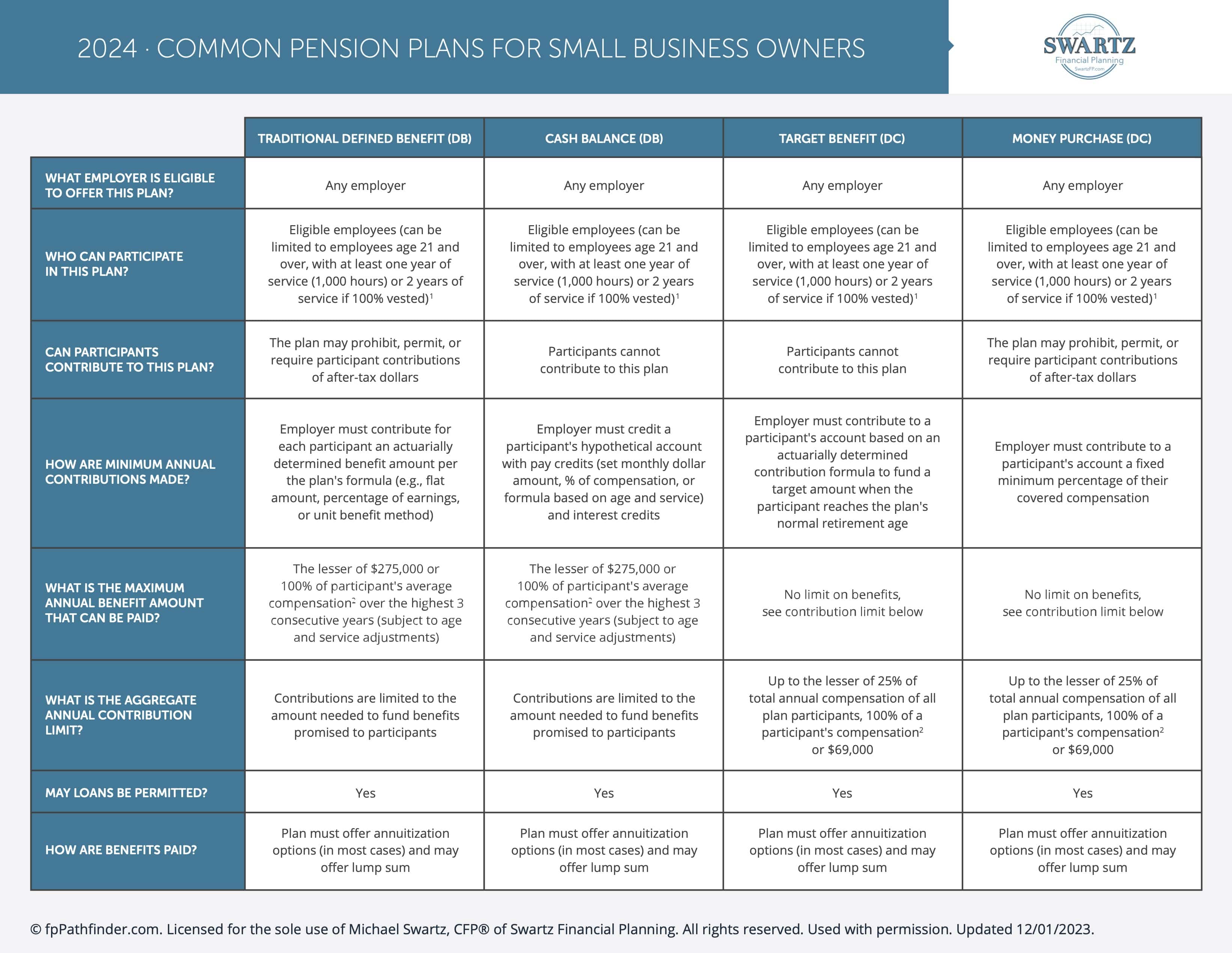

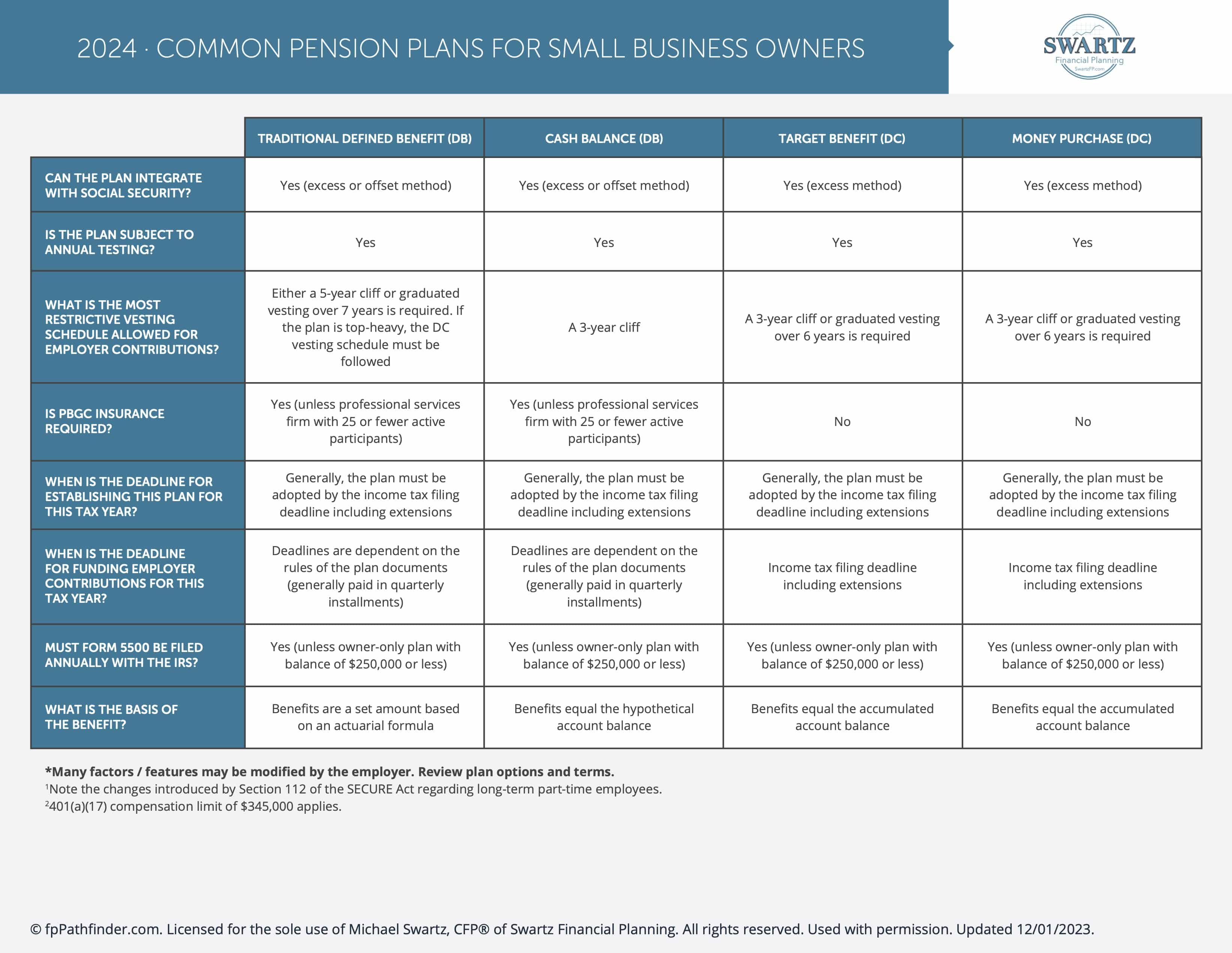

Common Pension Plans For Small Business Owners

Common Pension Plans For Small Business Owners. This chart will walk you through discovering common plans.

For small business owners, pension plans are vital tools in securing financial futures for both themselves and their employees. These plans provide tax advantages and retirement benefits, making them attractive options regardless of a company’s size. In this article, we’ll delve into several common pension plans available to small business owners, empowering them to make informed decisions about their retirement savings strategies.

Simplified Employee Pension (SEP) IRA

The Simplified Employee Pension (SEP) IRA is renowned for its simplicity and flexibility. Employers can contribute up to 25% of each eligible employee’s compensation, capped at $61,000 in 2022. Contributions are tax-deductible for the business and remain tax-deferred for the employee until retirement.

Solo 401(k) Plan

Designed specifically for self-employed individuals and small business owners with no employees other than a spouse, the Solo 401(k) Plan offers generous contribution limits and additional tax benefits. With a Solo 401(k), participants can contribute as both employer and employee, allowing for substantial retirement savings. In 2022, the contribution limit stands at $61,000, or $67,500 for those aged 50 and older.

SIMPLE IRA Plan

The Savings Incentive Match Plan for Employees (SIMPLE) IRA Plan is another attractive option for small businesses with fewer than 100 employees. It boasts simplicity and lower administrative costs compared to other retirement plans. Employers can opt to match employee contributions dollar for dollar, up to 3% of their compensation, or make non-elective contributions of 2% for eligible employees.

Defined Benefit Plan

A Defined Benefit Plan functions as a traditional pension plan, guaranteeing a specific benefit amount to employees upon retirement. Contributions are primarily made by the employer and are determined by factors like age, salary, and years of service. While these plans entail more administrative work and potentially higher costs, they offer substantial tax advantages and retirement security.

SIMPLE 401(k) Plan

Similar to a SIMPLE IRA, the SIMPLE 401(k) Plan is tailored for small businesses with fewer than 100 employees. It combines features of a 401(k) plan with the simplicity of a SIMPLE IRA, allowing for both employer and employee contributions. Employers can choose to match employee contributions dollar for dollar, up to 3% of their compensation, or make non-elective contributions of 2% for eligible employees.

Choosing the Right Pension Plan

When selecting a pension plan for your small business, consider factors such as the number of employees, budget, administrative requirements, and long-term goals. Each plan has its own set of advantages and limitations, so it’s essential to weigh your options carefully and consult with a financial advisor or tax professional for guidance.

In Conclusion

Pension plans play a crucial role in securing the financial futures of small business owners and their employees. Whether you opt for a SEP IRA, Solo 401(k), SIMPLE IRA, Defined Benefit Plan, or SIMPLE 401(k), choosing the right pension plan can pave the way for a secure and comfortable retirement for all involved.

See more flowcharts here!

This article is educational only and is not intended to be investment, legal, or tax advice or recommendations, whether direct or incidental. Again, this is not investment advice. Consult your financial, tax, and legal professionals for specific advice related to your specific situation. Never take investment advice from someone who doesn’t know you and your specific situation. All opinions expressed in this article are those of the people expressing them. Any performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be directly invested in.